With the exception of NZD, major currencies remained in tight ranges of less than 0.1%. The New Zealand dollar is currently the strongest currency today on the forex market, rising 0.2% against the greenback.

AUD/JPY is currently the strongest cross, with prices remaining above trendline support mentioned in today’s Asian open report. As mentioned we need to see a risk-off catalyst to drive it lower, but its inability to hold above 85.0 has not gone unnoticed.

GBP/JPY is yet to resume its uptrend with a break above 155.32, but it has found support at its 20-day eMA so, as things stand, we continue to suspect the corrective low has been seen at 154.13.

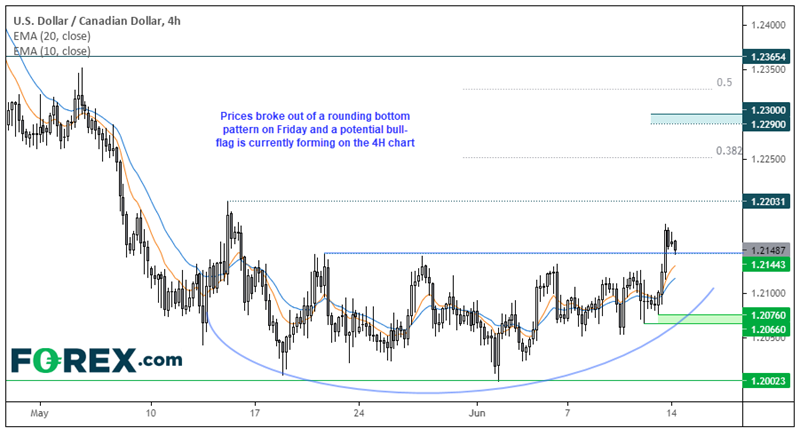

USD/CAD 4h Chart

USD/CAD has fallen over 18% since its March high, and retracements have been few and far between. But after holding above 1.2000 for several weeks, bullish volatility finally returned to break prices to out of its 4-week sideways range. In fact, prices appear to have formed a rounding bottom pattern which suggests a target sits just below 1.2300.

Prices gapped higher at the open and have retraced to its breakout level and a potential bullish flag is forming. Such levels aren’t always perfect so we can allow for some noise around it but, hopefully, prices will continue to coil in a tight range / flag pattern before its next leg higher. The initial target is the 1.2200 high, although the 38.2% Fibonacci ratio sits just above 1.2250 should prices continue higher, ahead of the eventual 1.2290 / 1.2300 target.

If prices instead close back beneath the breakout level today it warns of a bull-trap and the analysis will be reassessed.

By Matt Simpson, Forex.com » Official Website